The GenAI Divide: What MIT’s Data Reveals About AI Adoption

MIT research finds that 95% of companies aren’t capturing significant returns on their GenAI investments and reveals what the successful 5% are doing differently

Introduction

It’s 2025 and there’s hardly any enterprise who doesn’t either use technology or incorporate it into their business processes. It’s also no news we’re in the AI Boom era, where headlines scream about breakthroughs, every boardroom is talking GenAI strategy, and every worker has at least once leaned on ChatGPT or another LLM. Think about the software your company truly runs on. The CRM your sales team lives in, the design tool your creatives can’t work without… Now, think about the extra fee for these software licenses to get that AI feature, the new subscription to that AI agent and other AI incorporation.

What’s shocking is that groundbreaking MIT research reveals while nearly every company is experimenting and investing with AI, a whopping 95% see no measurable return on their investment and only a narrow 5% cohort is achieving significant operational and financial gains. This story has two main characters. On one side, we have the Buyers: the enterprises, mid-market companies and SMBs who have been promised effortless automation. They’re all rushing to adopt AI, whether to stay competitive, cut costs, or simply not fall behind the curve. On the other side, you have the Builders: the startups, vendors, and consultancies. They’re racing to create AI tools, platforms, and services that promise to unlock the future of work.

This phenomenon, termed the “GenAI Divide”, is not attributable to model capability, regulatory constraints, or a lack of technical talent. The core impediment is more structural. It’s that most corporate AI is built wrong for the job. It can’t remember, adapt, or improve. It’s a one-time-use tool in a job that requires a constant partner. It’s like hiring a brilliant employee who forgets everything you told them overnight. You have to start from scratch every single day. This “Learning Gap” is why these tools feel clunky, don’t fit into daily work, and are ultimately abandoned. Enterprises spend millions on pilots that stall, mid-market firms move faster but often lack scale, SMBs experiment without a roadmap, while many vendors and startups chase hype over staying power. The result? A widening gap where both sides are active, but only a small fraction are actually capturing measurable value.

High Adoption of GenAI but Low Transformation

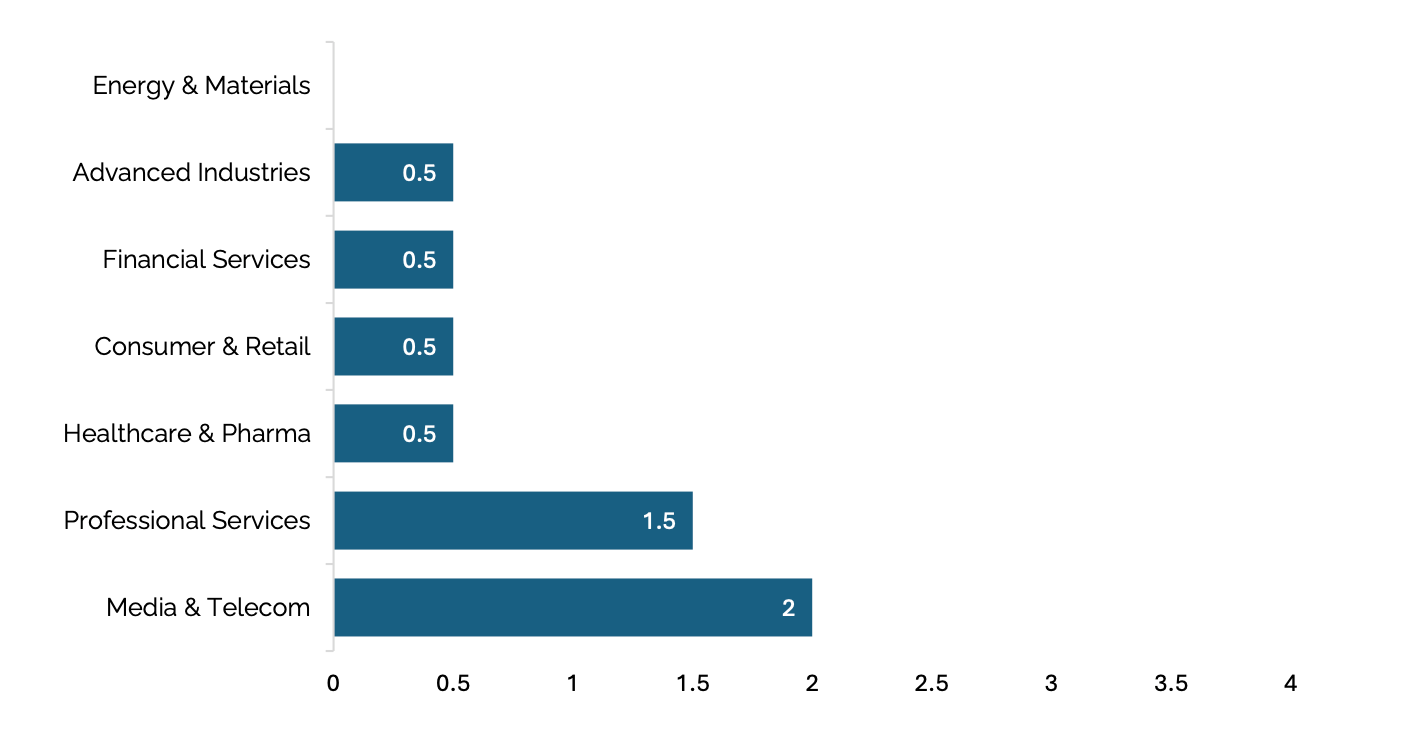

Many organizations have adopted the use of GenAI, but more often than not, it doesn’t change/improve their core business outcomes because the tools either do not fit workflows, do not learn over time or are deployed in the wrong places with the wrong governance. The authors of the research built an AI Market Disruption Index that measured organizations across 5 observable indicators with respect to the AI toolings they used, and they discovered out of seven industries, only two showed clear structural disruption: Technology and Media & Telecom.

This exposes some key insights: If an industry does not show new business models, new leaders, or measurable user-behavior change, then the activity is mostly incremental efficiency, not transformation. In practical terms, think of it this way:

Say a bank adopts GenAI to make their internal reporting more efficient; but if the loans model, the customer acquisition or fraud detection remains unchanged, then the business model hasn’t shifted.

Or a healthcare provider testing an AI scheduling assistant, but if the patient care models, health insurance handling or the treatment protocols look the same, the disruption almost remains a flat line.

Meanwhile, in media and tech, you can clearly see disruption. TikTok’s algorithm reshaped consumer behavior, and AI-driven content tools are changing how studios, creators, and advertisers operate.

So yes, AI adoption is high, but the transformation, the real redesign of work remains low. Without structural change in business models, most industries are just sprinkling AI on top of existing systems, not reinventing them.

The Learning Gap Behind the Divide

We’ve established that many organizations are experimenting with GenAI, but let’s look at another reason why only 5% see significant operational impact: The Learning Gap. Most enterprises can demo excellently in a boardroom, but once they’re put into practicality, used daily and consistently in organization workflows, they run into limits. The base of the problem is that many tools simply don’t learn. They generate outputs, but they are slow to retain feedback and adapt to corrections quickly.

The research showed that users consistently report four problems:

“It doesn’t learn from our feedback”

“Too much manual context required each time”

“Can’t customize to our workflows”

“Breaks in edge cases and doesn’t adapt”

The research also uncovered what they call the “shadow AI economy”, where employees secretly use AI tools to get work done. This shadow usage creates a feedback loop: employees know what good AI feels like, making them less tolerant of static enterprise tools. Here is what we do know:

90% of employees use personal AI tools for work tasks

Only 40% of companies have official AI subscriptions

Workers report using AI “multiple times a day, every day” through personal tools

Meanwhile, their companies’ formal AI initiatives remain stalled in the pilot phase

Why do these gaps exist?

These AI tools are often designed for demonstration value rather than long-term adaptability. They may improve in the coming years, but right now, they fall short due to the frequency of starting afresh very often, repeating the same mistakes and requiring one to re-explain context for every interaction. This is the Learning Gap. Even as organizations buy AI tools, the gap shows up as they shine for one-off tasks but collapse on ongoing projects, making them resort to alternatives, or ultimately back to human colleagues. The 5% of successful organizations have solved this learning gap by investing in AI systems that accumulate knowledge, learn from feedback, and improve over time.

How the Best Buyers and Builders Succeed

So how do the successful 5% get it right? The answer isn’t a secret algorithm or ensuring your organization has deep pockets, it’s a shift in strategy that aligns both Buyers and Builders around a single goal: creating AI that works with people, not just for them.

The research reveals that the most successful organizations treat AI procurement less like buying a SaaS subscription and more like hiring a partner. These organizations:

Demand deep customization aligned to internal processes and data

Benchmark tools on operational outcomes, not model performance

Source AI initiatives from frontline managers who already use ChatGPT, not central labs

Partner through early-stage failures, treating deployment as co-evolution

These buyers consistently emphasize specific priorities: “We’re more likely to wait for our existing partner to add AI than gamble on a startup”. They want AI vendors they trust, one who can build a deep understanding of their workflows.

On the other side of the equation, startups and vendors creating AI tools have also changed their playbooks. They understand their builds focus on learning-capable systems, not just raw intelligence, but deep in integration and adaptability.

They go narrow and deep, not wide and shallow. Instead of building an “AI for business”, they dominate one tiny, high-value task. Think of an AI that only summarizes sales calls and auto-updates the CRM. By solving one problem perfectly and embedding themselves seamlessly into that workflow, they become indispensable. They deliver immediate, undeniable value that is easy to measure.

They Build for Learning, not Just Output. The most successful builders design their systems to remember. They create AI that retains context from one interaction to the next, learns from user feedback, and gradually improves its performance. This directly solves the “Learning Gap” that kills other projects. They are not selling a tool; they are selling a collaborative partner that gets smarter over time. However, this also creates challenges around data governance.

When a buyer who demands a system is able to find a builder who specializes in deep, adaptive solutions for a specific workflow, then they both bridge the GenAI Divide together. Where the real ROI lives is when both successful buyers and builders discover that the biggest returns often come from unexpected places. While 50% of AI budgets flow to sales and marketing, the most dramatic gains happen in back-office automation:

Front-office wins: 40% faster lead qualification, 10% customer retention improvement

Back-office wins: $2-10 million annually saved by eliminating outsourcing, 30% reduction in external agency spend

Workforce reality: No major layoffs, but replacement of previously outsourced functions

The core lesson here is: the 5% succeed because they treat AI as a system that must learn, not as static regular software solutions.

Conclusion

It is important to note that the conclusions drawn from the above come from 52 organizations, 153 leaders and over 300 public AI initiatives and announcements. Therefore, actuality might vary on a larger sample size or a different industry. Nonetheless, we’ve seen that AI adoption is high and many are facing what the MIT researchers have labeled the GenAI Divide, which translates to low transformation rate.

It is the reason 95% of organizations see little to no return on their GenAI investments, and only 5% of them are succeeding. What differentiates them is strategy and implementation, and the core solution to this is bridging the Learning Gap. The 5% partner to build AI that accumulates knowledge, adapts to context, and becomes more valuable with each interaction. They:

Prioritize deep workflow integration over generic capabilities

Treat AI implementation as continuous adaptation rather than one-time installation

Focus on specific, high-value use cases rather than attempting enterprise-wide transformation simultaneously

In short, closing the GenAI Divide requires a fundamental shift in strategy. Instead of just buying new technology, companies need to focus on building learning systems. The insights from this research offer a practical blueprint for action that can be tailored to any industry. The bottom line is clear: companies must move beyond endless pilots by choosing AI that can adapt and improve, or they will fall behind competitors who do. With all this being said, we are still in the very infancy of GenAI. Thus, it is a learning moment for industry to identify what successful adoption looks like.

References

Challapally, A., Pease, C., Raskar, R., & Chari, P. (2025). The GenAI Divide: State of AI in Business 2025. MIT NANDA Project. Retrieved from [https://mlq.ai/media/quarterly_decks/v0.1_State_of_AI_in_Business_2025_Report.pdf]